Are you thinking about becoming a digital nomad and have no idea how to go about travel insurance plans?

Or are you currently on the road and are looking for peace of mind in terms of travel medical insurance? I’ve got you covered!

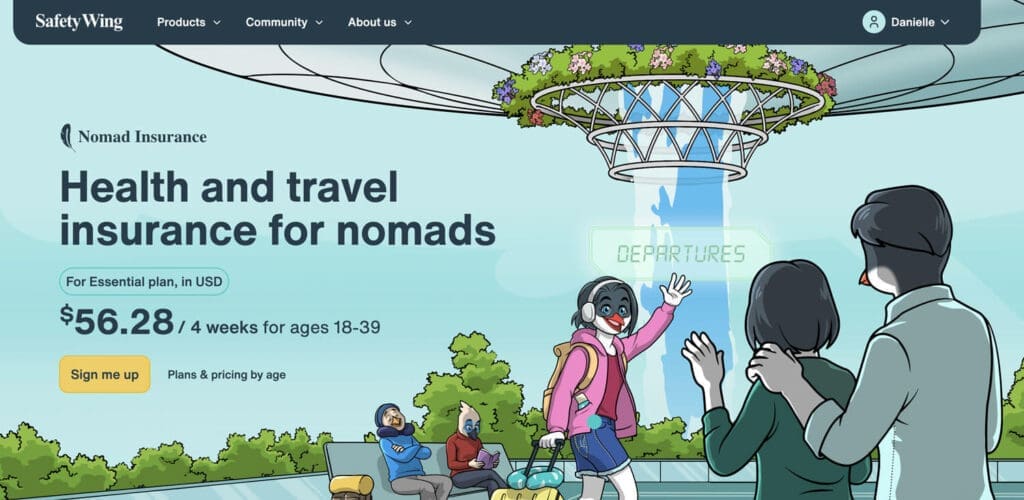

SafetyWing is the PERFECT low-cost solution for digital nomads with no home base.

I have been a digital nomad traveling the world full-time and running my online business for the past 6+ years now, and if you’re in the Digital Nomad Society, you’ll know SafetyWing is what I have been using for the past 3+ years non-stop.

I personally love having the peace of mind knowing that if anything goes wrong while I travel, I am covered.

In this blog post, I’m going to go over key features and benefits of being insured while traveling outside of your home country.

This post has affiliate links, which means if you purchase a product I get a commission at no cost to you. I only promote products and services that I personally buy and use myself.

I’m really excited to be sharing this Safetywing review with you all, so let’s get started!

What is SafetyWing?

SafetyWing is a global travel medical insurance company designed by nomads, for nomads. Therefore, it is engrained in their ethos to be adaptable and resilient.

It is an amazing choice for digital nomads because it offers coverage in more than 180+ countries, so you’re most likely covered in whatever destination you choose to go to next (even if you haven’t decided where you’re going next).

This was the perfect option for me, because other insurances require you to select exactly which countries you plan to travel to for the duration of the coverage period. I often don’t know the answer so it’s tricky if you have flexible plans!

SafetyWing also offer insurance for remote teams called Remote Health.

Full disclosure, I have no experience with Remote Health (yet), so I will be only covering SafetyWing Nomad Insurance in this article.

Who is SafetyWing for?

SafetyWing Nomad Insurance is designed for digital nomads, or those with flexible lifestyles.

If you currently spend, or are planning to spend, the majority of your time abroad outside of your home country, then this is for you!

They cover you for a 28-day period each billing cycle, so you are able to choose whether or not to extend every month.

This differs from other policies that require you to choose exactly when your start and end dates are.

Key Features of SafetyWing

SafetyWing travel medical insurance can be purchased while you’re already abroad. It operates like a monthly subscription.

Considering we just experienced a pandemic a few years ago, health issues and protecting your health are more important than ever. If you’re traveling or working remotely, you can rest assured that you are covered if you get sick.

$0 Deductible

There is $0 you need to pay out of pocket if you were to make a claim. This means you are covered even for the smallest of claims!

This is a HUGE contrast to the insurances I’m used to paying the the US, and I’m loving it!

Easy Sign-Up Process

As an online business owner and full-time traveler, time is so important as there are a million and one things that are always going on.

Keeping track of all the things on the never-ending to-do list can be hard enough already!

Which is why SafetyWing offers a quick and easy sign up process that takes just a few clicks.

You don’t need to wait to get a quote or callback, there is no pre-approval needed, and you can be signed up within the next 5 minutes.

You can sign up the day you fly out, or even if your trip has already started.

SafetyWing also doesn’t make you choose a home address, which means you don’t need to pretend to have a permanent residence. As they were founded by nomads, they understand your current address can change on a whim!

Peace of Mind

SafetyWing insurance ultimately gives me peace of mind when traveling, which is so important to me. The other great thing is they offer coverage for trips back home when you want to go see friends and family for the holidays.

This is capped at 15 days if you are a US-resident per 3-month coverage period, or 30 days per 3-month coverage period if you are a non-US resident.

If anything were to go wrong, you also receive 24/7 assistance from the SafetyWing team so you can get help and ask any questions when needed, no matter where in the world or what time zone you’re in.

This basically translates to: I know I’m always covered if an airline loses my luggage, or *knock on wood* get hurt in an accident abroad – which is amazing!

Essential vs. Complete

SafetyWing has two plans to suit your needs depending on your travel preferences!

The Essential plan is suited for the mid- to short-term traveller, covering travel risk and unexpected medical issues, starting at $56 USD every 4 weeks.

The Complete plan is designed for the long-term nomad, with both health and travel upgrades for comprehensive coverage, starting at $150.50 USD per month.

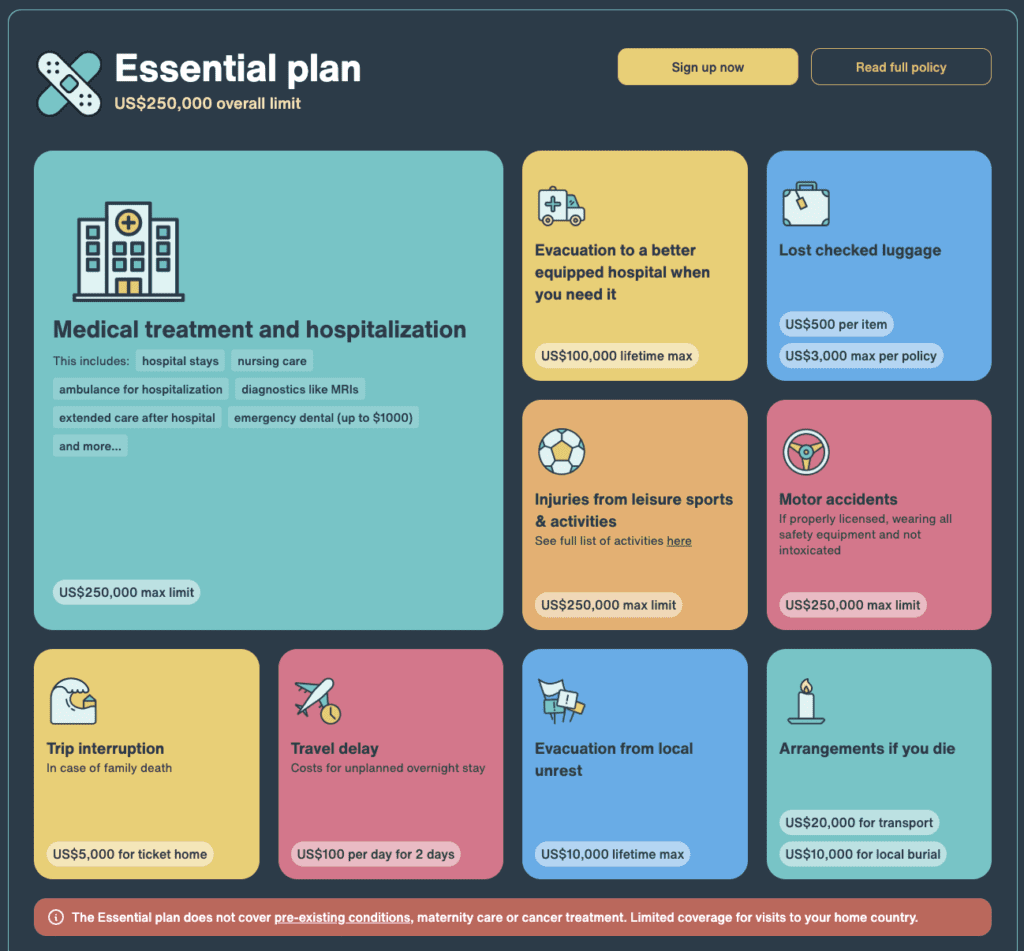

What is Covered by the ESSENTIAL SafetyWing Nomad Insurance?

Next, let’s go through exactly what is included in SafetyWing Nomad Essential coverage when you travel.

Travel Medical Insurance

The main feature that I find so valuable is emergency medical coverage while traveling, with a medical expense of $250,000.

This one is a big one, because you NEVER know when something can happen while abroad. Things like unexpected illnesses, or getting hurt in a car accident. SafetyWing covers you for eligible expenses like a hospital visit, doctor consultations, or medications.

Because I spend a lot of time in Indonesia where driving on the roads can be hectic, it’s always great to know that if I were to get into a crash (knock on wood), I will be covered.

As long as you have a proper license and are wearing a helmet, they will cover expenses related to car/scooter accident injuries.

Lost Luggage

Sometimes, airlines will lose your luggage, so Nomad Insurance will cover $3,000 per insurance period, $500 per item, with a lifetime reimbursement of $6,000.

Trip Interruption and Travel Delay

For trip interruption and travel delays, their policy covers $5,000. And if you’re stuck somewhere for the night, they cover $100 per day for two days.

Natural Disasters and Political Unrest

For natural disasters that cause you to switch accommodation, you’re covered with up to $100/day for 5 days. Political unrest is also covered up to $10,000.

Third-Party Injury or Property

And lastly, you’re covered for up to $25,000 for third-party injury or property, plus up to $2,500 for related third-party property.

Electronics Theft

There is an option to add on electronics theft, which covers laptops, tablets, and cameras for up to $1,000 per stolen item. This is great if you have lots of valuable equipment that you want insured.

So basically, from losing your luggage to having to go home for the unexpected, SafetyWing’s Nomad Travel Insurance gives you peace of mind, knowing you can have fun and enjoy and be covered if the unthinkable happens.

🤩 Check Prices and Availability

What is Covered by the COMPLETE SafetyWing Nomad Insurance?

Complete offers coverage of up to $1,500,000 compared to $250,000 in Essential.

It includes everything in Essential plus:

- Doctor and specialist visits

- Routine check-ups for preventative care

- Wellness therapies

- Visits with a psychologist or psychiatrists

- Cancer tests and treatments

- Maternity care

- Trip cancellation

- Stolen belongings

What does SafetyWing NOT cover?

SafetyWing does not cover any pre-existing conditions, and anything else that may fall outside of their Policy.

SafetyWing Pricing

Depending on your residency and age, they are able to provide you with a quote using the calculator below. I find it to be one of the most affordable options on the market!

It’s a pay as you go subscription, their pricing model is every 4 weeks, and you can cancel anytime.

I’ve signed up for insurance plans that cost upward of a few thousand per year, and others where you have to select exactly which countries you are planning to go to in order to get a quote for coverage.

With SafetyWing, you can get a quote immediately and sign up without needing to provide anything too complicated.

There are no strings attached and you can cancel anytime. All you have to do is choose the coverage length that suits your travels, whether it’s a long weekend getaway, gap year, or full-time travel.

🤩 Check Prices and Availability

Pros of SafetyWing

Affordability

The one main selling point for SafetyWing that I love is how affordable it is for flexible coverage. I personally pay $66.28 USD/month including electronics theft protection, which is just a few dollars per day!

Home Country Coverage

SafetyWing covers 30 days in your home country (15 days if your home country is the US) for every 90 days. If you stay in your home country longer, your coverage is void until you leave.

Specifically, the visit has to be incidental, which means unforeseen eligible medical conditions. You cannot return back to your home country for the purpose of obtaining treatment for an illness or injury from abroad.

24/7 Support

The SafetyWing team offers 24/7 support, which mean if anything were to happen, they can immediately guide you through next steps. They have a <1 minute response time! This gives you added peace of mind knowing someone is always one message or call away in times of distress.

Free Coverage for Children

With each adult policy, one child between 14 days and 10 years old can be included in the insurance without any added cost. They have a limit of 2 children per family that can be included for free, but this is amazing if you are traveling with kids.

Cons of SafetyWing

No Adventure Sports Coverage for US Citizens

If you’re a US citizen like me, you are not able to add on the Adventure Sports coverage for $20/month. This covers high-risk spots like surfing, and I wish they offered this for citizens of all countries! However, if you’re not a US citizen, this does not apply to you. It also doesn’t apply if you don’t engage in high-risk activities!

Understanding the Digital Nomad Lifestyle

Back when I was working a corporate job, the concept of being a digital nomad was a dream. I remember when my co-worker showed me an article about people working from co-working spaces in Bali, and I instantly knew that’s what I wanted in life.

Being a digital nomad means leveraging technology and the internet to grow your business online and/or work remotely.

Obviously, I’m a little biased and I always encourage my students and clients to start their own business in order to achieve time, location, and financial freedom. You can find out more in the Digital Nomad Society.

With this lifestyle, you are traveling very frequently, and you honestly never know what is going to happen.

In order to be at ease with the unknown, several factors come into play, and one is reliable travel health insurance. Over the past few years, having travel medical insurance has given me the peace of mind to carry on with activities I love.

The main reasons why digital nomads need specialized travel insurance are:

- We are not based in one country and need international coverage

- We need to be able to sign up for new coverage while outside of the country

- We need to be prepared for the worst-case scenario: from losing our luggage to getting hurt abroad

And this is exactly why I choose SafetyWing Nomad Insurance to come along all my travels.

FAQs About SafetyWing

Which medical providers can I visit while abroad?

The great thing is, you can go to an licensed hospital/clinic/doctor, either public OR private. They are also helpful with recommendations if you need them. The SafetyWing team is available 24/7 and answer within minutes.

How long can I be covered for?

You can sign up for automatic coverage extensions every 4 weeks until you cancel. They operate like a subscription, and you can continue to extend. SafetyWing always sends you an email before your policy extends and they let you know when your payment has been successfully processed.

You can find other Frequently Asked Questions on their website.

🤩 Check Prices and Availability

Final Thoughts: Is SafetyWing worth it?

For a low-cost, reliable, safety net while traveling, SafetyWing is what I would personally vote as #1 for digital nomads. It’s something I refuse to travel without.

With their global coverage, flexibility, location-independent focus, and 24/7 support for just a few dollars per day, you’ll definitely want to purchase this before you head abroad.

I hope you enjoy your trips while covered; I promise you’ll be so much more carefree, and you won’t regret having coverage.

Comment below if you have any questions about SafetyWing or the digital nomad lifestyle!

Read Next

How I Travel for Free Using Credit Card Points

What Time Freedom, Location Freedom, and Financial Freedom Mean To Me

Top 5 Digital Nomad Destinations (for Surfers)!

Attracting Your Perfect Life Partner As a Nomad

Holafly eSIM Review: Best eSIM for International Travel

What is the Digital Nomad Society?

How to Navigate Taxes as a Digital Nomad