Business Finance and Profitability Tips and Strategies for Small Businesses and Entrepreneurs

While managing your finances is the key to small business success, getting there can be quite a challenge! Especially if this is all new to you. Perhaps you’re struggling to secure funding or stay on top of your bills. If so, it’s time to take a step back and come up with a new strategy.

Not only will good financial management improve cash flow, but it will also increase profitability and empower you to make informed business decisions. Of course, it’s not easy and it requires a basic degree of knowledge. It will also help you to build trust and credibility, while opening a ton of opportunities along the way.

If you’re first starting out and you’re feeling a bit lost, then you’ve come to the right place. In this blog post, we’ll take a look at everything you need to know about business finance and profitability, including how to keep track of your income and the different financing options available for small businesses!

Tips for managing your finances

Whether you’re a small business or freelancer, keeping track of your income and expenses will enable you to control cash flow, stick to your budget, determine business profitability, and reduce your taxable income. Once you are on top of these things, you will also feel a lot more confident in your decision making as a business owner.

Setting a goal is the first step to getting on top of your finances. A financial goal is anything to do with your money. Maybe you want to reduce your outgoings by a certain amount or increase your revenue. The trick with successful financial goal setting is to keep it specific, realistic, and measurable. You’ll also want to set a deadline to help stay on track. Once you have set some financial goals for the year ahead, you’ll then be able to work on your budget.

To reduce expenses and increase your revenue, you’ll need to implement a few strategies including cost cutting measures. Take a thorough look at your expenditure and try to negotiate better prices with your contractors. Are you charging reasonable prices for your goods or services? If you think your fees are too low, now is the time to increase them.

Maybe there’s a new market you would like to reach or perhaps you want to develop a new product or service. Both of these options are a great way to increase your income! If you are considering a new market, undertake some thorough research beforehand to avoid jumping into something you are not quite ready for.

A great tool to get your accounting in check is Quickbooks Self-Employed.

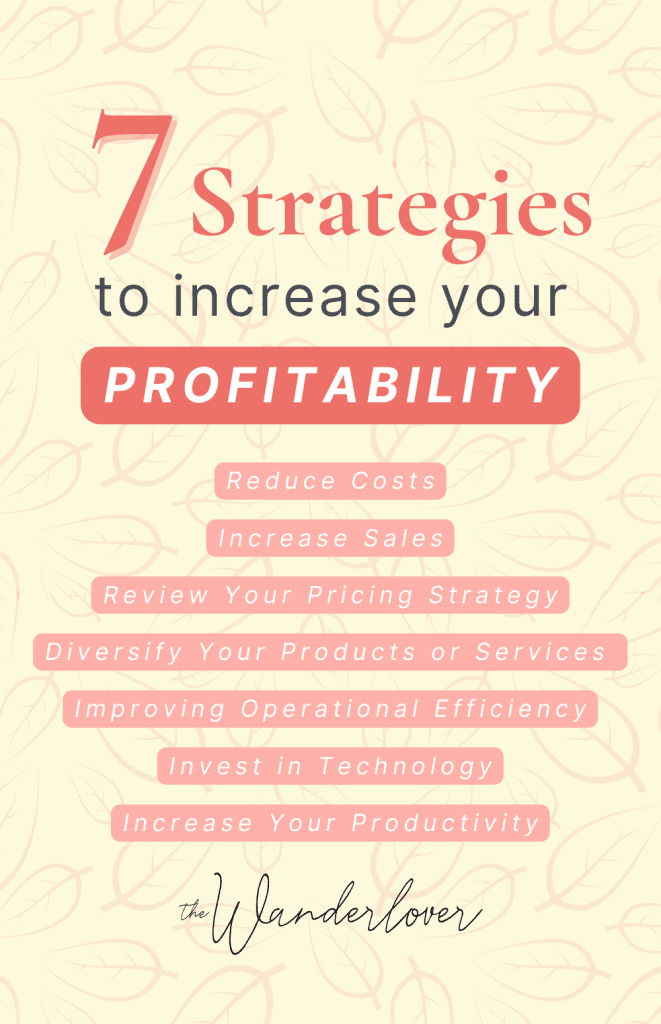

Strategies for increasing profitability

The word profitability simply means your ability to make profit or financial gain. Profit, therefore, is everything you earn after accounting for expenses, such as cost of goods sold, operating costs and taxes. It is calculated by subtracting expenses from revenue and it’s a critical measure of a businesses financial performance and ability to make money. In most cases, a business that generates consistent profit is considered a financially healthy and sustainable business.

Some ways you can increase profitability:

Reduce costs

Look for where you might be able to cut unnecessary costs, streamline production processes or negotiate better deals with suppliers. By reducing the costs of running your business will help increase your profit margins.

Increase sales

Kind of obvious right. Making more sales will result in higher profit. Growing your customer base, expanding into new markets, and increasing the average sale value can all help to boost sales values and increase profitability.

Review your pricing strategy

Have a look at your current pricing structure. Can you optimize this to increase profitablity? Think about dynamic pricing, increasing prices for your most in demand products and services, or offer discounts or promotions.

Diversify your products or services

Can you add another product or service to your offering that can expand your reach or drive repeat purchases? More products also gives you some protection and reduce the impact of any changes in demand for your product or service.

I talk a lot more about this in episode 121 of the Wanderlover podcast where I get into detail about the 7 income streams that have built the Wanderlover to be a 6-figure business which grows every year. Listen to How to Diversify Income Streams Within Your Online Business

Improving operational efficiency

In this step we are looking at your operations processes. Identify and eliminate bottlenecks in your processes and automate repetitive tasks. This combined with Lean or Six Sigma methodologies can help improve efficiency and increase profitability.

Invest in technology

You have probably hear that you have to spend money to make money. Few places is it more true than when it comes to investing into tech. From automations, to analytics, to AI, all can help reduce costs, improve efficiency, and increase revenue.

Increase your productivity

Increasing productivity will mean you get more done with your time. This means less time costs, and will help drive profitability.

This list is by no means exhaustive, and are just some places to start.

What If you are experiencing low profitability?

If you are experiencing low profitability, there are a few things you can do to identify and address the root causes.

First, you will want to analyse your financial data and look for trends over time. Look at your income statements and balance sheets to identify where expenses are higher than income.

Next, you’ll need to examine the cost structure of the business. Break it down into fixed costs and variable costs with fixed costs relating to everything that must be paid regardless of how much you are making from your products or services. On the other hand, variable costs entirely depend on the amount of work you have at any one time. For example, a common variable cost is labour. Creating a cost structure will enable you to confidently reduce your expenses and set prices.

Identify areas where you may be underspending or undercharging and consider making some changes. Take some time to evaluate the efficiency of business processes. It’s also important to find out what your customers think of your services. You can do this via online surveys or a simple email requesting testimonials. Feedback is also very useful when developing marketing strategies and other aspects of your business.

Financing options for small businesses

When setting up a small business, chances are you’ll need some funding. With so many options out there, it’s important to understand the different types of funding available. Let’s take a look at the most common funding opportunities for small businesses and freelancers.

Crowdfunding

A popular choice for entrepreneurs, crowdfunding is where someone backs your business idea financially in return for a discount or reward. For example, if you have a new product, you may offer it at a cheaper rate or provide your ‘backers’ with an exclusive free gift to go with it. Crowdfunding is a great way to gain financial support for your idea, especially when you are just starting out. You keep full ownership of your business and can also ask for feedback.

It offers low financial risk and can even help to build your brand. Unfortunately, with so many entrepreneurs using this type of funding, it can be difficult to stand out from the crowd and secure enough backers.

Online Loans

If you want a quick turnaround, then online loans can be a good option. Unlike traditional bank loans, you can apply from the comfort of your own home making it a whole lot easier for freelancers who are always on the go. The criteria is often far more lenient than bank loans and you can usually access the funding faster. If you are considering an online loan, it’s also important to recognize that interest rates and fees are often far higher than traditional bank loans.

Small Business Grants

For business owners, grants are the ultimate goal. Essentially they are free money that you don’t have to pay back. When you are first starting out, the idea of a grant is way more appealing than monthly loan repayments. While there are plenty of small business grants out there, competition is pretty stiff so you will need to spend time perfecting your application.

If you find a grant and match the criteria, then there is absolutely no harm in trying. Just try not to get your hopes up and be realistic about the amount of time you can put into an application.

Cash Flow Lending

These short term loans are another popular choice for small businesses and freelancers. With short application forms and quick turnarounds, it’s safe to say that they are a quick and easy way to inject some cash into your business. This type of loan significantly varies from lender to lender so watch out for interest rate rises, hidden fees and charges.

Conclusion

So there you have it. Financial management and increasing profitability are sure ways to achieve a healthy and successful small business. Good financial management can really enhance your business and keep it afloat. Understanding your finances will empower you to make important decisions, set prices, provide detailed reports and make better projections. You’ll also be able to manage your budget better while staying on top of bills, paying off debt and making funding applications.

If you feel like this information has gone way over your head, fear not. There is plenty of support to help you improve your financial management skills. Undertake your own research, enroll on an online course or seek advice from a professional business coach. Not only will it help your business to grow but you will also notice a huge improvement on your overall well being.

Resources:

Using Cost Structure Analysis to Maximize Profit | Harvard Business Services (delawareinc.com)

6 different types of finance to help your business grow | Prospa NZ

8 Small Business Financing Options: Get The Funding You Need – Forbes Advisor

Share on Pinterest