Tune in or read the blog version below!

Quick Links

✧ Join The Wanderlover Coaching Group

✧ Download Your FREE 0 to $100K Game Plan

I also recorded a YouTube video explaining this concept if you prefer to watch instead!

Hello from IGA Lounge in Istanbul, Turkey

Hi everyone! I am actually recording this episode in a little private workroom in the IGA Lounge at Istanbul Airport.

This is my first podcast I’ve recorded out in public, but we have a 15 hour layover here. We’re at this amazing lounge. It has so many amenities and I was like, you know what?

Done is better than perfect. Might as well speak from the heart and talk about a topic I love.

Does anyone else love people watching at airports? I swear that’s like one of my favorite things to do and it just makes time pass by so quickly.

We just finished a 12 hour flight from Singapore to Istanbul and now we have a long layover, and then we have another 15 hour flight from Istanbul to Mexico City.

I’ve been to Turkey once before, and this time we’re not leaving the airport. We’re posted up at an incredible lounge. There is a pool table, open bar, huge buffet, lounge area, meeting rooms, private working rooms, so it’s very comfortable.

Istanbul Airport was actually named Conde Nast’s Best airport in the world of 2022. It’s really big, really luxurious, and I’m just sending all of you all the travel vibes as I move from Indonesia to Mexico.

One of the best investments I make that makes ALL my travels stress-free in times like this is SafetyWing Travel Medical Insurance, which covers travel delay, lost luggage, trip interruption, and medical expense of $250,000.

It’s a pay as you go subscription that you can cancel any time, and you can be insured from just a few dollars per day.

How To Travel For Free

Today is the perfect day to talk about something I get a lot of questions on, which is how do you travel so much? How do you travel for free?

And I really want to give you guys behind the scenes of how I travel for free using credit card points. Personally, I have not paid for an international flight in the past four, maybe five years.

So every single international flight, including this one, including some of my husband’s, I’m able to use points to cover and it saves me a chunk of cash.

And of course it gives me the option to reinvest that chunk of cash that I would’ve used on flights back into my business.

I’m really excited to show you guys how it’s done.

Disclaimer: I am an American Citizen

I do want to preface this mainly works because I am an American citizen, I have a social security number and I’m really able to tap into the American banking and credit system. It’s not this generous In other countries that I’m aware of.

Ragz is British and we tried looking into different credit cards in the UK – it’s not comparable.

The only kind of similar one is the American Express Gold, which you can apply for in the UK, but it has foreign transaction fees and the signup points and the conversions aren’t that lucrative.

So as far as I know, this works because I am American. If you are listening to this and you’re American, you can definitely do the same! If you’re not, maybe look into the banking system in your own country, but do your due diligence and do your own research.

Points Hacking Overview

Every single purchase I make in my life is done on a credit card, either one of my personal credit cards or one of my business credit cards. I hardly ever, ever use a debit card.

Sometimes I’ll use Transferwise, but 95% of the time I’ll always have my spending on a credit card.

With the credit cards that I have applied for and signed up for, with every purchase I automatically get either points or miles that I can then redeem for anything travel related like free flights or hotels or car rentals.

They can be business class flights or first class flights too.

There’s no limitation as to what I can redeem them for, but every time I spend on something I would’ve purchased anyway, I’m automatically getting credit card points for travel on the backend and those accumulate over time.

What’s even better is I’ve optimized my strategies so that for certain credit cards, I use them for certain categories of spending to give me even more points.

How do credit card points work for travel?

For example, my Chase Sapphire Reserve credit card gets me 3x the number of points on dining and restaurants. So every time I go out to eat, let’s say my bill comes out to $50, I will get 150 points that I can then use towards travel at a later date. I know a lot of people think credit cards are a bad thing, like banks try to take your money and they’re charging you interest.

But there is a really intelligent, manageable way to use the system to your advantage!

Of course, we’re not gonna have outstanding debt, and of course, we’re not going to be buying anything we can’t afford and paying interest.

I want you to think about your credit cards like a debit card, you’re using it to buy stuff you would anyway with cash, but we’re just putting it on a credit card.

We’re paying the balance off in full at the end of every single month and we’re building our credit score. You need to have a really solid credit score to make this all work. So make sure you have your finances in check. Make sure there are no late payments. Set up automatic payments if you can to make sure your credit is as high as possible.

The Two Categories Of Rewards Credit Cards

So now that you know you can automatically get points or miles based on your spending, you’re probably wondering which one should I open up first? That’s going to be completely dependent on your situation, but I want you to think about different credit cards as in two categories.

Airline Specific Cards

The first is airline specific credit cards. For example, United has their own credit card, Delta, American Airlines, Alaska, Hawaiian, Southwest, right? All of these credit cards have their own point system with that specific airline and you get more points and more benefits when you book through that airline.

This is beneficial if you are based in one city. So let’s say you fly out of Miami a lot or you fly out of LAX a lot, it would be a lot easier for you to get a lot of points with one specific airline if you’re constantly using them.

Generic Spending Cards

The second category is a blanket points-based credit card. These are generic spending credit cards like the Chase Sapphire Reserve or Amex or Capital One. These aren’t airline specific and instead they are linked to a specific bank.

And what happens is every time you spend on those, you accumulate points instead of miles. So you accumulate points and based on their specific transfer partners, you’re able to then transfer over to their partner airlines, their travel partners, and then use those points with airlines like Alaska with United, with American, etc.

The second way you can redeem those points when it’s a bank specific credit card is you can book through their own travel portal and use the points like cash.

How to Use Credit Cards for Flights

Now that you have the points, let’s go through how to use points to travel.

As an example, with Chase, every point with their transfer partners are usually transferred on a 1:1 basis. If you redeem them as cash towards travel, they then use a 1.5 multiplier, which means instead of one point equaling 1 cent, every point is then 1.5 cents.

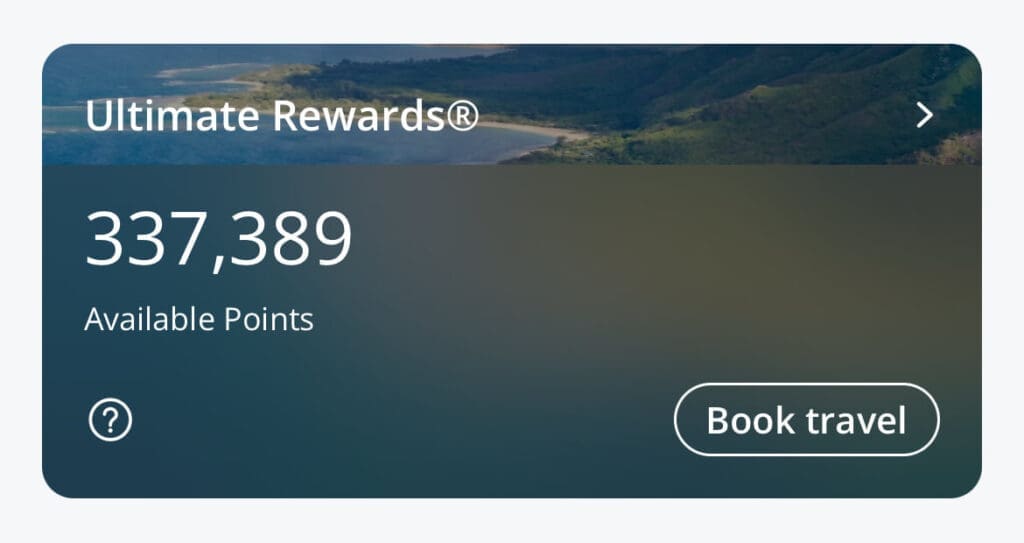

If you had 10,000 points, you can use that towards $150 of travel. And if you have 100,000 points, you can use that towards $1,500 worth of travel. And so you can see how over time, as you are accumulating more and more points, you can basically redeem and travel on points!

Sign On Bonuses Hack

And now you’re probably thinking, “Danielle, a hundred thousand points is insane! I would have to spend so much money in order to get to that level and I don’t know if my expenses are that high!”

The good news is with any of these credit cards, either airline specific or bank specific, they have sign on bonuses. So what I used to do was I would sign up with United and get their credit card. They would have a sign on bonus ranging from between 50,000 to 80,000 points if I spent $3000 USD in the first six months.

Usually every single one will be like spend between $3,000 to 5,000 in the first 3-6 months and you’ll get between 50,000 and 100,000 points. So keep an eye out on these award miles because they fluctuate a lot if you wanna apply when it’s higher!

Because once you spend that and you get that, then all of those points show up in your United account. And with all of the airline specific ones, they have the first year of credit card fees waived.

What I used to do was I would open up a United Credit card, get the sign on bonus within the first year, and then cancel the credit card. All of those points would be still sitting in my United account, but my credit card would be canceled.

I would do the same with Delta, and then the same with American Airlines, and just have all of these airline specific points in my accounts.

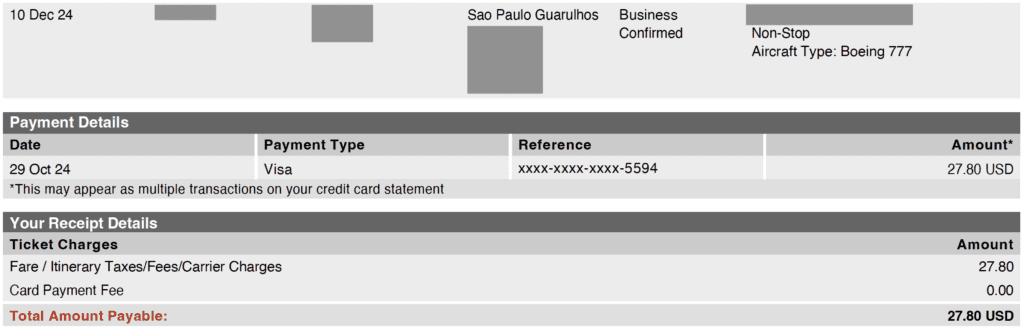

Flight Prices with Miles and Points

The prices of flights available with points and miles varies depending on the time of year and flight route, but I have bought business class flights for as low as 35,000 American Airline points!

With many other airlines, 60,000 points will usually get you round trip flights from like New York to Europe. And this is simply by receiving ONE sign on bonus!

They are so worth it if you know how to play the credit card game, right?

Of course, you don’t want to just be mindless about signing up for so many and then forgetting to cancel or not be on top of your payments, right? You really want to make sure you have an understanding and a grasp of this so you can manage this well and use the points and miles to your advantage.

My Experience With Airline vs. General Credit Cards

Again, signing up for these airline specific ones, are good if you are based in one place and you don’t have such high spending.

But what I’ve migrated over to over time as my business expenses increased as I really wanted to learn how to best approach miles and points is I stopped signing up for airline specific credit cards.

Instead I only work with Chase, Amex and now I’m venturing over to Capital One as well because you can transfer all of those points over to ANY airline.

So it’s not like I have to only fly United or only fly American. I’m basically optimizing the point system so that any airline I want to fly in the world, I’m able to book for free.

How To Find Award Flights

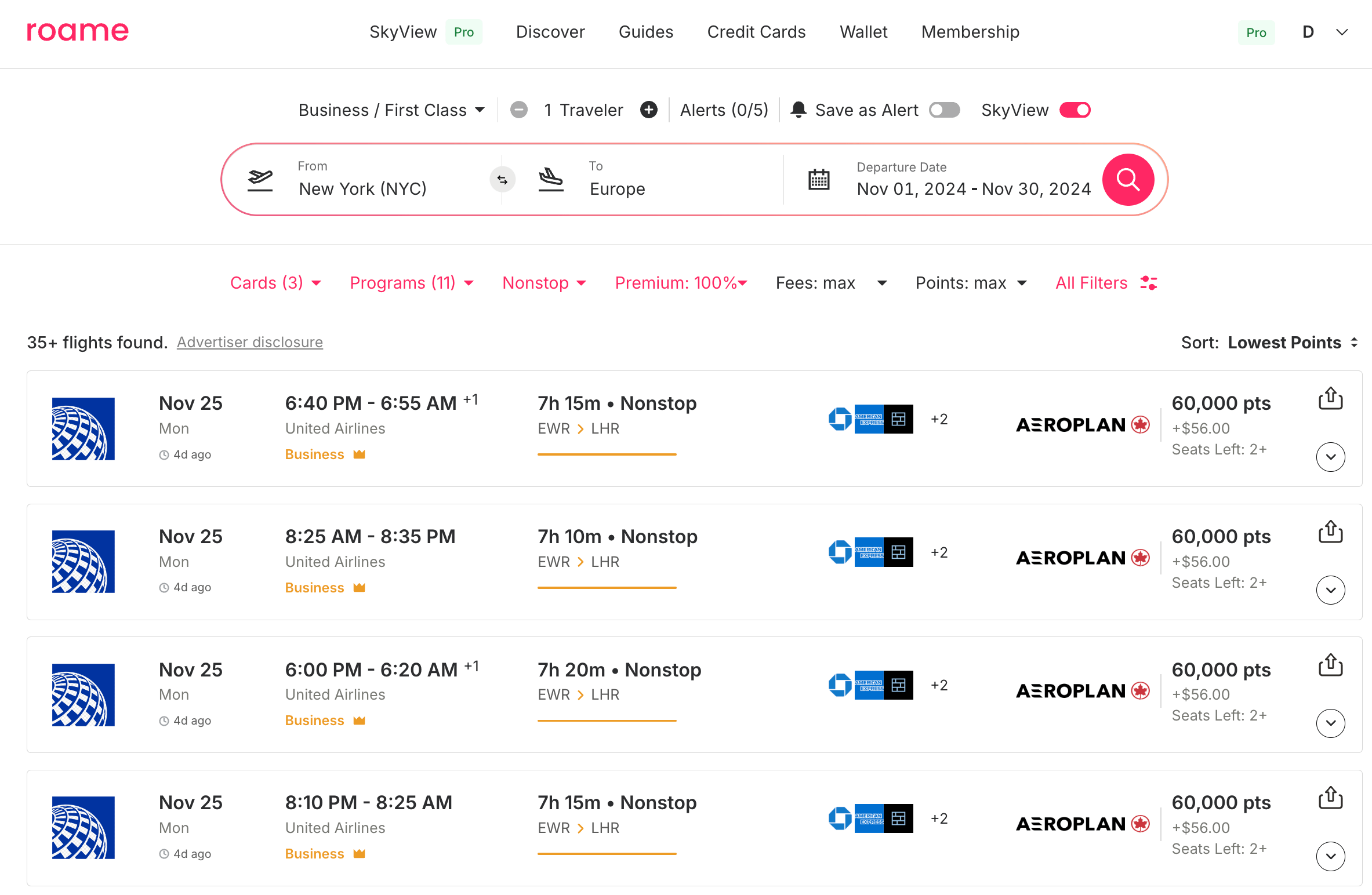

A handy tool I use to find the best deals on award flights is Roame.travel. You will need a subscription to access multi-day and multi-location searches, but you can use basic searches for free.

As you can see, I can book a direct business class flight from New York to London for only 60,000 points and $56.00 if I transfer Chase, Amex, or Bilt points to Air Canada Aeroplan.

They transfer on a 1:1 basis, so if you sign up for one of the credit cards and get a sign on bonus, it would be enough to cover your ticket!

This tool makes it easy to see which airlines are offering award flights operated by their partner airlines.

In the above example, it is likely that this 60,000 Business Class flight is NOT offered by United itself, but instead by their partner airline Air Canada.

And instead of having to search the same route on all partners, you can immediately see the best options displayed in your results!

The Pro version comes with multi-day searches if your dates are flexible, and multi-location searches if you want to end up in some general area of the world (South America, Europe, Japan, Indonesia for example).

Credit Cards I Use and Recommend

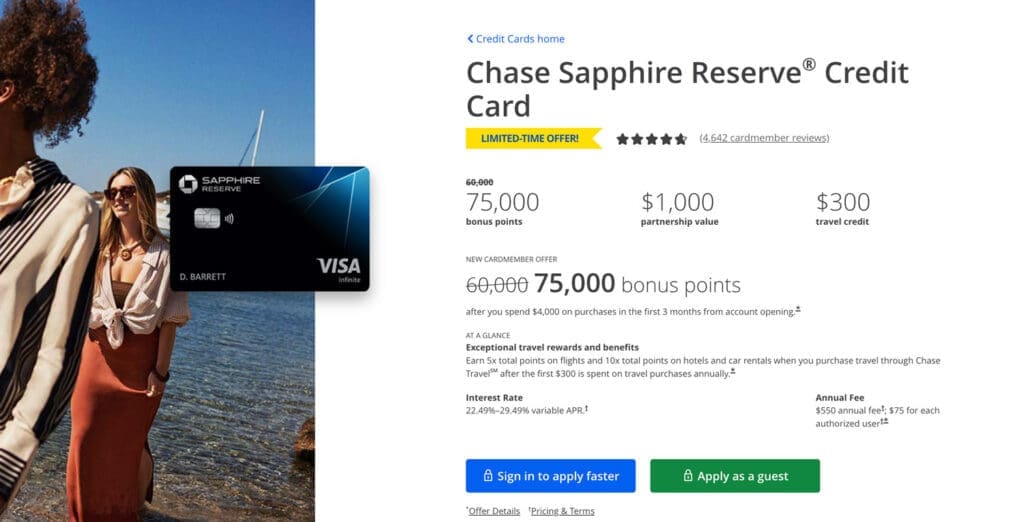

Chase Sapphire Reserve

The main credit card I use for personal expenses is the Chase Sapphire Reserve. It has a $550 USD annual fee, but it comes with so many perks that makes it so worth it. Mainly, you get a $300 travel credit off the bat, which you can hit really easily.

Anything like Ubers or flights or Airbnbs or hotels that you book throughout the year, if you hit $300, they’re going to reimburse you. So that already brings it down to $250.

You then get Global Entry, which is another a hundred dollars application fee that lets you enter the country so much easier when you’re coming from another country and going through immigration.

You also get Priority Pass, which is so helpful if you travel a lot and you get access to its entire lounge network across the world.

90% of the time when I go to an airport like this one, for example, this amazing one in Istanbul, it’s part of Priority Pass. So I just show them my priority pass that I get for free with Chase, I’m able to enter, I’m able to eat, you get to drink (alcohol included), you get to use their amenities.

I took a shower here to freshen up, so it’s really nice and just so worth it for me. Like I said before, there are certain categories that have three times awards. So every time I travel or eat out, I get 3x the number of points. And so with my personal credit card, that’s the main one I use.

Amex Gold Personal

I also recently signed up for the Amex Gold Personal. This is my first Amex card because like I said, I do want to diversify my point transfers because Chase only has selected travel transfer partners and I want to start tapping into the Amex travel partners as well.

I signed up for the Amex Gold personal. There is a $250 annual fee, but you get 90,000 points if you spend $4,000 in six months, which I think is so reasonable. And you get 4x points when you buy food with it. So this is going to be my main food card.

Like do you see how just by applying and spending what I would normally spend, I’m getting 90,000 points that’s redeemable for $900 worth of travel or I can transfer over to travel partners. And sometimes you have first class business class flights for 50,000 points.

🤩 Apply for the Amex Gold Personal card here and receive 60,000 bonus points >>

Chase Business Ink Preferred

Now for my business expenses, I mainly use the Chase Business Ink Preferred. This gives me 3x the award points when I spend on things like supplies and marketing like Facebook Ads. I can combine the points I get with my business with the points that I get from my personal Chase Sapphire Reserve because they’re part of the same system. So I’m able to combine everything together.

I also recently just opened the Chase Business Ink Unlimited, and that gives me 1.5% cash back on everything. And so that’s probably gonna be like my blanket card for when I don’t get those increased multipliers for spend categories.

And with the Unlimited, I can also pull together all of my points with my other Chase credit cards as well. There’s no annual fee for the Business Ink Unlimited, I get another 90,000 points if I spend 6,000 in 90 days, which is again, very doable and there’s no annual fee at all.

You can see how my points just keep accumulating and as I travel, I can easily use them to redeem points for my, myself, my family, and my friends.

If you sign up for one today, within three to six months, you can get another 60,000 to 90,000 points in your account!

🤩 Apply for the Chase Business Ink credit card here >>

Research To Know What Is Best For You

So this is definitely something you should think about. I personally have plans to open up even more credit cards. And of course like this is going to vary per individual.

But because I’m always traveling and because I don’t have a base, this system works really well for me. The amount of value I get from paying a few hundred dollars using this credit card is just so, so worth it.

Like the lounge I’m currently in, I believe it’s 80 euros just to get in and I was able to get me and Ragz in for free. We get unlimited food and amenities and drinks and we have such a long layover.

For times like this, I’m like, thank goodness for my annual fee and for my credit card!

There is also no one size fits all strategy because your business, your life, your expenses are going to be different. Do your own research. I feel like with this episode you now have an understanding of how you could use it to your advantage. So look at your travel schedule, look at your expenses, your finances, see if this makes sense for you.

If anything, just plant the seed and set the intention that you’re going to figure this all out and create this system for you and it will happen, right? You are able to travel for free. I’ve been doing this for years and years and I’m still learning new ways to optimize my strategy, which is really exciting.

Other Credit Card Options

The next few credit cards I’m looking at opening, maybe you guys want do some research on these as well.

I’m going to open the Capital One Venture X for my personal expenses, the Amex Blue business plus for another business credit card and Amex Business Gold, and then maybe a hotel card. If you have any questions about them, just send me a DM.

One last thing also is that some of these credit cards have 0% APRs for the first year, which is really, really handy!

You can get all of your bonus points, you can have basically one year of spend with no interest.

Conclusion

Signing up for rewards credit cards has been one of the best decision of my travel career, and I know you won’t regret diving in. I hope this episode was enlightening and it helps you find your next award mileage flight and get started on free travel!

Who can complain about that, right? How much better can it honestly get?

I will see you guys in the next episode when I am in Mexico! Have an amazing week and I’m sending you all so much love.

If you’ve enjoyed this episode, it would mean so much if you could leave a review on Apple Podcasts. This helps us spread The Wanderlover mission to those who need a dose of inspiration today.

Read Next

Holafly eSIM Review: Best eSIM for International Travel

SafetyWing Review: Best Travel Insurance for Digital Nomads

How to Start a Travel Blog: Become a Travel Blogger and Make Money Blogging

How to Become a Travel Influencer

8 Proven Online Business Ideas That Allow You to Travel the World

Couple’s Vacation Guide to O’ahu, Hawai’i

The Perfect One Week in Bali Itinerary for First-Time Visitors