In this episode, we cover how my childhood shaped my money mindset (04:00), how I shifted my mindset from a scarcity fear-based mindset to an abundance mindset (13:27), and questions you can ask yourself and exercises you can complete to help you change your views on money (22:35).

Quick Links

✧ Join The Wanderlover Coaching Group

✧ Download Your FREE 0 to $100K Game Plan

Audio Transcript

Hi everyone! Welcome back to The Wanderlover Podcast. This is episode number 30. Whew. You know that we celebrate every milestone in business, no matter how big or how small, and this is a huge milestone for us.

(46s):

So thank you all for being a part of this journey. And before we get started with this week’s episode, it would mean so, so much to me, if you could leave us an honest review on Apple podcasts. So I think if you just go to the wander lover podcast page on the podcast app, scroll all the way down, there should be a section for you to just leave a quick star rating and review. If you’ve learned a few things just from tuning in or had some shifts in mindset or business wins, we would love to hear about them. So if you do leave a rating, which I really hope you do, please feel free to include them all in there. Also quick life update. I don’t think I’ve even shared on Instagram yet, but I just love sharing with you guys.

(1m 30s):

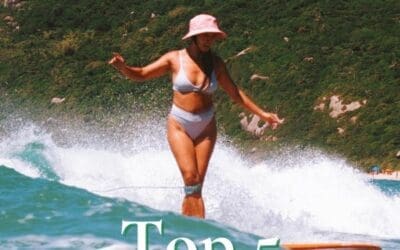

First and foremost, this week we are flying back to Hawaii. So you guys know how much rags and I love the Island. Love the surf love. The people honestly would have stayed there just indefinitely, but Ragz is a British citizen. And so we unfortunately had to leave after 90 days. But now we are back in New York and we have our flights booked for April 15th. Yay. So if any of you are in the area tuning in from Oahu or are planning on visiting, let me know and let’s connect. Maybe we’ll go out for a surf session. So this week’s podcast episode is all about how shifting my money mindset changed my life and business.

(2m 13s):

This episode was actually inspired by last week’s momentum mastermind curriculum, where we talked and focused all about money, mindset, about pricing in our business, brought in a guest speaker, talking about how we need to change the way we think in order to change the way we execute in business. And I have a feeling that as you’re listening to me speak in this episode, you’re going to be like, Oh my God, that is, so me. How many times has that happened? I’ve had so many people in DME and they’re like, I feel like you’re talking to me. This is how I think. And it’s really refreshing to hear that people go through the same struggles, right? And that’s why I’m addressing them.

(2m 54s):

So you are not alone. And if you resonate in any way, shape or form, there are other people going through the exact same thing and we are all going to get through it together. So in this episode, I’m going to start off by sharing my money mindset journey. How I realized that my story about money that I was telling myself was no longer serving me. And it was all in my head. So that moment where I was was like, why am I thinking like this right awareness? I’m going to be sharing when that happened and how that has impacted my life and my business, how shifts to an abundance mindset literally change the way I live.

(3m 36s):

And we’re going to end by questions to help you recognize patterns in your life and business. And we’re going to of course, connect it all together, using the examples that I’m about to share with you. So it’s a very honest, vulnerable talk. I obviously feel comfortable with all of you listeners and I really appreciate you, you know, giving me the time to be able to explain things online. So let’s get started. I want to say that my story may relate more to other Asian American immigrants. So if you guys tuned into the episode where I shared about how my parents immigrated from China to America, when I was two years old, you’ll know that I am a first generation immigrant.

(4m 19s):

And when you’re young, when you’re relying on your parents, your environment to basically sustain your life, right? This is where all the conditioning happens. This is where you learn the most about how you can survive in the world around you. And so for me, growing up, we didn’t have a lot of money. We moved around a lot because my parents would constantly be getting new jobs and I had to switch school districts. And I was always a new girl. I had to learn from a very early age that I needed a sacrifice, what I truly wanted versus what was the most financially feasible for us at the moment. So stories that I remember that revolves around money at a very early age was like, we would go into an accessory store for like, it was called morning glory.

(5m 6s):

Do you call that like a stationary store? Right? It was Korean American stationary store with really cute anime, like notebooks and pens. And every time we would go in, because it was next to my daycare, I thought everything was so pretty, but it was too expensive and it was just not affordable. So at a very early age, I started noticing, you know, like these are things that I like, but I can’t have because of money. And other things I picked up on subconsciously was don’t go the extra mile and pay for something. If you can do it yourself and save a few dollars and do it at home. So this would go for, you know, getting my nails done or even haircuts.

(5m 48s):

Like I didn’t get, I didn’t go to a salon until I was maybe like in my late teens or early twenties. And just a lot of things, you know, if you can do yourself, why would you need to spend that money on something else? So there was also a distinction that time wasn’t the most important, the money you saved was valued more and don’t get me wrong. I had an amazing childhood. Like my parents literally spoiled me in any way that they could at the time giving their capabilities. I obviously am so empathetic to the fact that they struggled. Right. And they really just came to America to give me a better future and went through so, so much.

(6m 29s):

So I’m not trying to be like this. Like I was suffered when I was little. I really am not. But I’m just sharing these instances with you guys, because I, I realize that it’s small things like these that never learned to be aware of and shift. So even if you’re in a completely different financial situation, you know, 20, 30 years later, you’re still picking up on these little habits. And so we’re going to dive more into that later in this episode, but yes, don’t get me wrong. My parents are amazing human beings and I wouldn’t be living the life I’m living now, had it not been for their hard work and sacrifice. So the last example I want to share about my childhood, where the topic of money came up was when we ate out at restaurants or at food courts or any place where we basically had a meal outside.

(7m 19s):

And I remember every time or in the beginning, when I would want like a soft drink, a Sprite or a Coke, it was frowned upon, right? Because you could ask for water and water was free. So that was something I learned and also to not order the most expensive thing out of restaurants. So no matter where the place was, you always kind of just had to look at the prices of things and go from there. It wasn’t like you look at the menu and then the prices, it was, you look at the prices first and then the menu item. And honestly, if I were to have talked about this a few years ago, I feel like I almost would have thought I felt ashamed.

(8m 2s):

And as I’m exploring that too, I realize that money was kind of like a shameful thing growing up. Right. We never really talked about it openly. We knew that it, like we knew that we didn’t have enough, or I felt like we didn’t have enough. And it was just this thing that I had no idea how even to make, but we didn’t have enough of it. And it brought us things that we wanted, but couldn’t really afford. And it was just a weird, it felt weird to talk about it. It felt shameful, but these are all opinions that we have formed and we are capable of changing. So the reason I shared those three examples were because those were the examples that literally have carried themselves through most of the entirety of my life, without me even knowing, or was conscious about.

(8m 56s):

So even, you know, years later from going from a child with no money to an adult, with a corporate finance job, every single time I go into a stationary store or a bookstore, I’ll immediately think that everything in there is unnecessary or that I can’t afford it. And the main thing to know is that I have the money in my bank account, right. But I subconsciously will convince myself that it’s not necessary and that I don’t need it. And I can’t afford it. It’s a feeling same thing goes with getting my nails done, getting my hair done. I said, I didn’t do it for most of the entirety of my life.

(9m 36s):

And it wasn’t until I was like, wait, why don’t I just treat myself, right? Why don’t I just spend the money? Because it makes me feel good. And it’s realizing that it sums from having to sacrifice what you desired versus what was necessary at an early age. And so, as I grew older, my money story never really changed, but it basically sabotaged my business and my life for a while throughout high school, throughout college, I had an underlying scarcity mindset. It was very much fear-based where I needed to save every penny. I truly believe that money was hard to come by and I needed to do everything I could to save money and have a savings in my bank account.

(10m 23s):

I was so crippled by the fear that one day all my money would go away and I would have to struggle, right? Like I would have to, you know, just use my savings and sustain life because I never knew what could happen with my money. So this manifested itself, when I was in business and mind you, you know, I was working a corporate finance job. I was making more than 70 K a year. So I had the money to invest in a business, but still because of all the habits that I had formed, all the money stories, I was telling myself from an early age, when I bought my first domain, I didn’t want to even pay for hosting. I was like, I can find a freeway to do this myself.

(11m 5s):

Don’t need to hire a web designer. I can do everything myself and save the money. Does this sound familiar? This also manifested itself by not investing in what I knew would help me. And instead, trying to piece together, everything using freebies, using free YouTube videos, free resources, right? Like if I was trying to learn about Pinterest, I would not pay for a Pinterest course. I’d be like, all right, let me go to YouTube and Google, how to use Pinterest and try to learn intensive 15 minutes. This also looked like refusing to pay for any subscription service because growing up, you know, like we had a habit of kind of calculating how much a subscription would be if you multiplied it by 12 and that’s how much money you’re like wasting quote unquote wasting in a year, even though it adds so much value to your life.

(11m 57s):

Right? So I use Lightroom, I use Photoshop and I would try every way to Torrance it, to get these apps on my computer illegally, but for free. And what would be so annoying was that when there were updates, they obviously, you know, crack down on everyone doing this. And so you would lose access to it. And it would be another day or two or week of trying to figure out the next best way, wasting so much time just to try to get this free software, because I didn’t want to pay like $35 a month for it. So do you see how the same money story has been coming up for me over and over again? And I just never really connected the dots because I had never gotten a professional haircut that I could spend time cut my own hair at home, or have my mom do it for me.

(12m 45s):

It translated into, you know, trying to spend the time to do something. That’s not at a professional level to try to get free things, to try to sacrifice your time in order to save a few dollars. When in the grand scheme of things, now we’ll talk about abundance mindset, but in the grand scheme of things, that time could’ve been used so much more effectively. And I think this is the main difference between having an operating on a fear based scarcity mindset versus an abundance mindset. You are so much more focused about the money you’re spending about the money you could save, then the time you’re spending versus the time you could save.

(13m 27s):

And so how did I transition from a scarcity fear-based mindset to an abundance mindset? The first step was awareness. And I think this awareness came to me when I was just so frustrated by not having the answers I was looking for, right. Looking and spending so much time on these freebies on these YouTube videos. And as soon as there was someone who put a price into a valuable service, I was like, Oh my God, no, they’re trying to sell me something. They’re like a used car salesman and I have to save all of my money, but again, the day came or I was just so frustrated by not knowing what to do, not making money from my side hustle.

(14m 10s):

And I was like, if I want to quit my job by July of 2017, I need to be making this thing work. And at the time I was working on so many different projects, but for Instagram, I had no idea how to monetize my Instagram. So I took the leap and I bought this ebook that was $30. And it taught me everything about Instagram. And I was like, Oh my God, this is actually so valuable. And I would never have learned this in any YouTube video. So I think it was at that moment where I realized investing in my business would actually provide returns and provide value that saved me so much time.

(14m 53s):

And granted that was the first step, right? My money mindset. Didn’t obviously just change overnight, but it really, it really proved one of my money stories wrong. It proved that I could invest in valuable things and see a return in my business. So that misconception that even if you’re investing, you’re like throwing money away, which I kind of always thought, even though it doesn’t make sense because the term investing itself means that there is a possibility of return with obviously calculated risk. But I felt really good about that investment. And I think over time, it’s slowly, it slowly grew on me where I realized that things in business just work better if you put money into it.

(15m 39s):

So this goes for my website, I finally invested into a really good hosting. I invested into masterminds into courses, into coaching, and it was through all of these scary money investments that made me really challenge my money story, right? Because it’s the culmination of all of the beliefs, all of the mindsets, all of the thoughts that you have in your head that basically produce a manifest themselves into the life that you are currently living. And so how did shifting my money stories and my beliefs around money change my life. And I’m going to call this phase two, because phase two is all about abundance. We just did our taxes for the past year.

(16m 20s):

And I looked at my business investments. We had spent over $20,000 on coaching and on courses. So wow, like that number coming from the girl a few years ago, who would spend all of her time trying to gather every single freebie on the internet, right? To just spending more than 20,000 on coaching, it proves how you really have the power to change your mindset. And you guys all know within the past few years, my life completely changed. So going from corporate America to putting my job to starting an online business, to working with five star hotels around the world, the coaching, other creative entrepreneurs from my laptop and the wander lover has grown to be an international brand that literally is all about freedom and entrepreneurship.

(17m 16s):

And the core essence of entrepreneurship is creating something from nothing. How powerful is that? Because creating something from nothing also translates into income, into profit, into money in your pocket. It’s the knowing that you have the power to create anything that you desire and you get properly compensated for it. So this also means working on the inner stuff. So you have the confidence and you have the willpower to price what you are worth. So pricing, let’s dive into pricing because this is the biggest obstacle that new entrepreneurs face when it comes to money mindset and how their childhood stories basically translate over to sabotaging their business.

(18m 2s):

So me, for example, because I, of course spent all my time trying to do things for free, obviously have never hired a photographer before. When I landed my first collaboration ever with seamless and spent hours trying to produce content for it. I charged $60 for, I think maybe a total of three to four hours of work, because I was like, Oh, it’s reasonable that, you know, I can spend, I can get paid $15 an hour because that’s more than minimum wage. And I am a new photographer and all of these limiting beliefs when it comes to who am I to charge higher? Who am I to be charging more than $15 an hour for my time?

(18m 45s):

And other than services, I didn’t have products. Yeah. I didn’t have services. And I really, I relied solely on affiliate links because I figured, you know, it was all passive. I didn’t have to promote myself. I didn’t have to put my face out there and I could just live off of affiliate links, making a couple dollars per sale, even though I didn’t have the traffic for it. And then one day I remember seeing one of my influencer friends post a screenshot into her stories of her getting paid $800 via PayPal for a collaboration. And at that point I was like $800 from your side. Hustle is impossible.

(19m 25s):

If not like, just way out of my league, I basically talk myself out of why I shouldn’t be charging that number. It just seemed like such a ridiculous number that when I saw it, I immediately thought that I couldn’t do it myself. And now looking back all fear, right? No confidence, because why would someone else be able to do it and not you? So you might be looking at other bloggers, other coaches, other influencers, other people in your niche, and you might be self justifying. Why you will never be at that level. It might be because they have, you know, the looks or the brains or any part of their characteristic, which is just basically not applicable just to convince yourself that you are not capable of attaining that success.

(20m 14s):

So just after the past few years of working on my business, working with other people on their businesses and just being really aware of how your mindset sabotages your business success. It’s so apparent to me that we all go through the same thoughts and we all have the same thoughts, but it’s only those who are able to change their thoughts that reach the level of success that they want. So nowadays, what do those new money stories look like? Going back to my first example, going into stationary stores or morning glory and thinking, wow, these things are too expensive. And realizing that in business, I’ll still think that certain investments are to expect, but realizing that that’s not serving me and having the service service or whatever it is that I want, what actually add value to my life, I have the power to change my financial decisions and be like, you know what?

(21m 11s):

I’m going to buy this for myself and I’m going to make the money back. So being empowered and knowing that being creative leads to income and profit. The second one, the story of doing things myself, I now know that my time is the most valuable resource on that planet. And if something is going to save me time and money, and if someone else is better than better than me at doing it, why not pay for it? So it doesn’t only have to be about beauty services, right? To me about website, it can be about blogging. It can be about anything you can outsource, get the help if you need it. And the last one instance of not ordering a drink at dinner or not ordering the most expensive thing at the time.

(21m 56s):

And you, you know, if you have something thing that you really want and it’s expensive, there’s probably a reason for it, right? The reason that a Philemon Yon is more expensive than a chicken is probably because I don’t know it’s more in demand. And I personally like it more. So I’m going to get the steak. Same goes for coaching and programs and courses. Yes, you can buy knockoff, coaching and courses, but they’re probably not going to impact your life the way that a $2,000 course or a five figure coach is going to impact you. So really think about these and see are they serving you or do you have the power to change them?

(22m 38s):

So an exercise that I did with my masterminders and I would love for you to just take a moment and really reflect, you can journal, you can write it down, but reflect on the money story that you’ve been telling yourself all your life, and really just bringing this awareness to it and seeing are there, are there ways you can improve, right? Like, are there ways that you could think that would serve you better in your life in business? So three total questions. The first question is for you write down three to five money behaviors that you observed your parents or your guardians, or your loved ones practicing during your childhood.

(23m 19s):

And again, these are monumental because very rarely do they not affect you. When you’re learning as a child, you’re trying to, you know, gather so much information and most likely they will impact you the way you treat money, the way you view money, they will probably impact you today. So write, write them down. And if you want to discuss them with someone, feel free to DM me. I love like just holding space for you and listening to what you have to say. So first question really reflect on the earliest memories you’ve had growing up around money. Second question circle, the behaviors.

(24m 1s):

You still practice as an adult. So similar to what I did this episode, you know, not ordering a drink at dinner and only water. So I still practice that a lot of times I’ll still think that I need to be getting water, even if I really want an IC. And when I go out with people who don’t do that, it will still like invoke a reaction. I’m not, I’m obviously not going to be like, Oh my God, you like, didn’t get water because I’m not financially responsible for them. But internally it’s something I noticed, which is so hilarious because you know, like I’m 27 years old and I can obviously afford an ice tea, but it’s just a subconscious habit.

(24m 44s):

That’s really humorous to be aware of. I eat almost every meal with rags. And when we go out, even when he gets like, I dunno, like three large Cokes, I’m like, I’m not gonna say anything, but you know, it secretly is something I am aware of. So yeah. Circle the behaviors you practice as an adult, it’s really fun. Then the last question is, how is this money story sabotaging your success? And you can put a number on it, right? Like if it’s, if your money story being like I would never pay a thousand dollars for a course is preventing you from charging a thousand dollars for your course, that’s sabotaging your success because there are so many people out there out of the billions of people in this world who would pay a thousand dollars for your course.

(25m 38s):

So how are these current money stories in your head, sabotaging your business and your life success? So if you have a money story that, you know, it’s impossible to make money outside of a corporate job, I’m not capable of being an entrepreneur. And that’s keeping you stuck in a job. You hate, that’s almost sabotaging your potential in life because you’re so convinced that you’re going to fail. If you were working in your corporate job. And that just might be totally debilitating. So let’s explore that. And I know I said three questions, but this was just like a bonus one I threw in for my masterminders is write down everything that you made in 2020.

(26m 24s):

So your annual income, if you’re in a corporate job, write down your annual income. If you are not, if you’re an entrepreneur, write down how much you made as an entrepreneur last year, and now multiply that number by 12. So if you were to make your annual income in one month, what feelings come up for you are you immediately like, that’s impossible. I can’t do that. Do you have any limiting beliefs surrounding that number as a monthly income? And let’s explore that because that is also a self-imposed money mindset block in this universe, you are literally capable of doing anything that you set your mind to.

(27m 9s):

So why is it that certain numbers trigger you? Right. And think about it. Your numbers are also impacted by your environment growing up. So if no one around you or in your current environment or anyone that you know of has been able to achieve that income level, you probably think that it’s impossible for you, but it’s not. Or even, I feel like all of us know someone famous or someone rich or someone where like, Oh, they make a lot of money, right? And we kind of see them as this they’re a fluke, or you try to justify that you can never attain that level of success in the way that they have, but that’s also a self-imposed limit.

(27m 53s):

Why wouldn’t you be able to make your annual income in a month? Right? Let’s really challenge that and explore those feelings and try to connect how your money stories from when you were a kid kind of translate to what they manifest themselves in right now, it’s a really powerful exercise. And once you’re able to identify the reasons why you think the way you do, that’s when the magic happens. That’s when you’re like, wait, why do I think this way? Why am I self-sabotaging right? Because we all know that action and execution stems from your mindset.

(28m 33s):

If you don’t believe that you can, you’re not even going to try. So moral of the story moral of this episode, really be aware. Let’s try to shift our stories to ones that serve us. I’m going to end this episode with some of my favorite money affirmations, write them down, repeat them, internalize them. They are amazing. So first money affirmation. Money is easy to come by. Second money flows to me from all directions continually more and more with total ease and flow Three, I get to make lots and lots and lots of money For the more money You make, the more money I make and then keep on making.

(29m 33s):

And five. This is one that I repeat to myself over and over again. I always make money. When I travel, I make so much money when I travel and all of these affirmations feel free to adjust them to whatever you see, fit, feel free to add them to your journal, add more and more and more money affirmations here. Journal. The more we have conversations around money, the easier it is for us to talk about it with our audience, right? There’s no reason for it to be icky. There’s no reason for it to be like, you know, at a taboo topic. One of my favorite books on money mindset is your a badass at making money.

(30m 13s):

And in it she’s like money is like sex. You know, everyone, no one wants to talk about it, but everyone expects you to be an expert on it and to be having like lots and lots of it, which I found hilarious. So let’s start having these conversations. My DMS are always open and I hope this was an inspiring episode that you will listen to over and over again, sending you all so much love!

~~~

If you’ve enjoyed this episode, it would mean so much if you could leave a review on Apple Podcasts. This helps us spread The Wanderlover mission to those who need a dose of inspiration today, thank you!